PRB 99-14E

EXCHANGE-RATE REGIMES:

Prepared by: TABLE OF CONTENTS B. Benefits and Drawbacks; Credibility and Reserves C. Canada and the United States: Optimum Currency Area? D. Special Case: Currency Boards E. Special Case: Adoption of Currency C. Which Countries Should Use Floating Rates? EXCHANGE-RATE REGIMES:

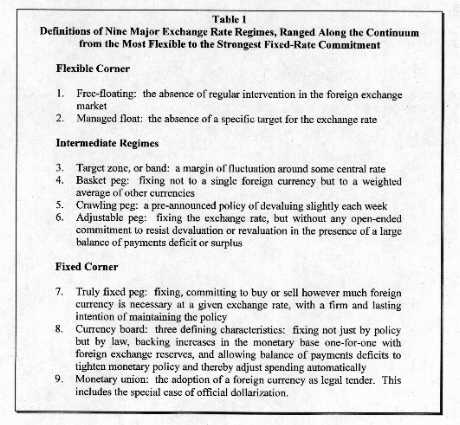

Recent events at home and abroad have reignited the debate over what the proper exchange-rate regime should be for a given country. In mid-1997, Thailand sparked the Asian financial crisis when it failed in its defence of its overvalued currency, the baht, and was forced to remove it from its peg to the U.S. dollar and float it. As the crisis spread, Asian political leaders spent their foreign exchange reserves to defend their pegged rates, mostly meeting with no success. Asian countries have lost years of hard-earned development as a result, and the crisis has even threatened the political stability of Indonesia, the world’s fourth-largest country, which remains a powderkeg. In Canada (which is under a flexible exchange-rate regime), the long-term depreciation of the dollar against the U.S. dollar—from $1.04 in May 1974 to under 65 cents in December 1998 (it is currently around 67 cents)—has caused increasing concern that the low dollar is adversely affecting productivity and Canadians’ standard of living. Consequently, those who criticize floating rates for Canada have suggested considering greater exchange-rate fixity with the U.S. dollar, including the options of dollarization or adoption of a common, possibly North American, currency. Both Canada’s choice for its own exchange-rate regime and the choice of other countries are of great concern to this country. The benefits of an appropriate domestic exchange-rate regime are obvious, while any move toward a stable international financial system is to be welcomed: as the Asian financial crisis demonstrated, in a global economy, financial crises can be exported. This paper sets out the pros and cons for the spectrum of possible exchange-rate regimes; while this information is relevant to the Canadian experience, readers seeking a more Canada-specific treatment are referred to "A Common Currency between Canada and the United States: Key Arguments for and against" prepared by Peter Berg of the Parliamentary Research Branch in 1999 for the Standing Senate Committee on Banking, Trade and Commerce. Straddling the financial economy and the real economy of goods and services, a currency’s exchange rate(1) is an important signal of the strength, stability and productivity of an economy and the value of its financial securities. Exchange rate fluctuations can have a real effect on individuals and businesses. If the exchange rate falls, the level of foreign-denominated debt rises and the price of imports increases. Any imports used in domestic production become more expensive, pushing up the price of the goods produced and possibly leading to inflation. If the government raises interest rates to fight inflation, production and employment will drop. A government’s choice of exchange rate has significant consequences for the entire economy. If it chooses an appropriately structured regime, the country can benefit from greater stability, with the exchange rate acting as a signal to direct the international flow of capital toward its most productive use. If a government chooses a regime poorly suited to its needs, instability, currency and general financial crises can result, as recent events in Asia have demonstrated. The proper exchange rate regime depends on a country’s particular circumstances.(2) In broad strokes, exchange-rate regimes lie on a continuum from a fixed exchange rate (the national currency is pegged at a set rate to another country’s currency, or, in extreme cases, another country’s currency is adopted as legal tender in place of the national currency) to a floating exchange rate (market demand for the currency determines the rate with no intervention). Table 1 lists the nine major exchange rate regimes, from most flexible to completely fixed.

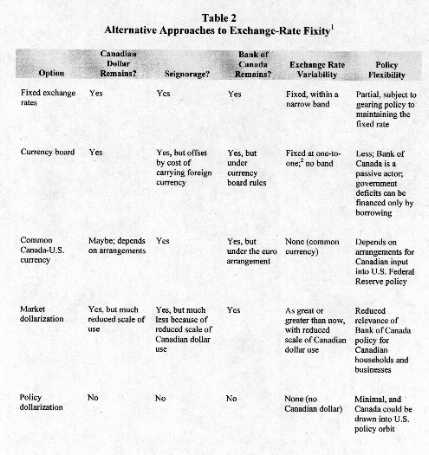

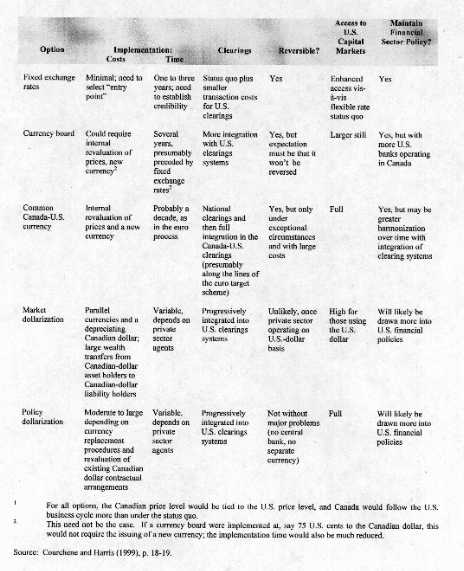

The traditional factor in determining exchange-rate regime has been vulnerability to external shocks. In the case of an external shock, a floating exchange rate will bear the adjustments, while a fixed exchange rate will cause adjustments to be borne by wages and prices. Economic theory holds that small, open economies should fix their rate, while larger countries should float. The choice of regime carries an extra importance for developing countries. In a country with a poorly developed financial sector, where there is little diversity in securities, the exchange rate serves as the main pricing signal for investors. Thus extreme fluctuations in the exchange rate can unsettle investors in an emerging economy to a greater extent than investors in a mature economy. Traditionally, since the 1973 collapse of the Bretton Woods arrangement, the larger countries—such as the United States, Japan, and Germany—have floated their currencies in the world market, small countries have fixed their domestic currencies to the value of one of the major currencies, and medium-sized countries have pursued an intermediate approach. With the advent of the European Union, EU currencies were linked to the German mark and replaced by the free-floating euro. Following the failure of intermediate-style regimes in Asia, Russia, Brazil and Mexico, however, such regimes, which attempt to capture the advantages of both extremes, have fallen into general disfavour, with economists recommending either fully fixing or floating a currency. One analyst suggests that "anything in between (fixed and floating) is too dangerous."(3) This concern is based on the concept of the "impossible trinity," which states that a country must give up one of three goals: exchange-rate stability, monetary independence or a high level of international capital mobility. In a world of increasing capital mobility, a country can choose a fixed rate but must give up an independent monetary policy; can float the exchange rate and have monetary independence, but at the cost of exchange-rate stability; or can have capital controls, but at the cost of international financial integration. There is no consensus on one "right" regime for all countries at all times. Both fixed and floating exchange rates have benefits and drawbacks. With international mobile capital now a given, countries must choose between the stability of a fixed rate and the independent monetary policy control offered by a floating rate. While the choice of an exchange-rate regime might still be obvious for countries like the United States (floating) and Panama (dollarization, an extreme form of fixed rate), most countries lie somewhere in between these two extremes. With intermediate regimes in disfavour, the choice of exchange rate regime, especially for emerging economies, is as uncertain as it has ever been, and perhaps more so. Stable money is vital to economic coordination and business planning. Likewise, all countries wish to avoid the disruptions caused by currency crises. Even according to these criteria, it is difficult to choose the exchange-rate regime. What’s more, according to the World Bank, over the past 30 years more crises have hit countries with flexible exchange rate regimes than have hit those with fixed rates, though the latter countries have experienced more severe crises. While certain exchange-rate regimes are more appropriate for some countries than others, it is important to note that policy mistakes contributing to an international financial crisis can occur under any regime. Similarly, all exchange-rate regimes should be rooted in strong financial sector regulation and appropriate monetary and fiscal policies. Several academics have suggested that one way to eliminate exchange rate crises would be for every country to adopt a world currency. However, the strong national symbolism of currencies, coupled with the lack of a world lender of last resort and the lack of the political consensus necessary for such a beast, generally make this idea a non-starter. Under a fixed exchange-rate regime, a country pegs its currency to that of another country (or a mix of the currencies of other countries) at a fixed rate, with the firm intention of maintaining that policy. Fixed exchange rate regimes include the extreme cases where currency boards are introduced and another country’s currency is adopted to replace the domestic currency (dollarization—adopting the U.S. dollar as legal tender—is a specific case examined below). For a description of the various issues involved in moving toward certain types of fixed exchange rates, see Table 2.

Typically, a fixed rate benefits a small country with: 1) a high degree of openness to trade; 2) high labour mobility; 3) a fiscal mechanism to moderate recessions; and 4) a business cycle highly correlated to the country to which it wishes to peg. Such countries would benefit by joining in an Optimum Currency Area (OCA).(4) The United States is one example of an OCA; the European Union, despite its common currency and monetary policy is not, technically speaking, an OCA. Moreover, a country wishing to import monetary stability and that was lacking in credible public institutions or facing exceptionally panicky investors, could benefit from the stability of a fixed-rate regime,(5) since it would be importing the monetary stability of the larger country. Getting a fixed exchange rate right is essential. Too high a rate will increase the relative cost of exports and reduce the relative cost of imports, resulting in a ballooning trade deficit, which will be followed by an attack on the currency, loss of foreign exchange, and eventually a "corrective fall" in the exchange rate. If banks issue a large amount of foreign-denominated debt, this scenario could threaten the banking system. Thailand is an example of a country whose fiscal and monetary policies were incompatible with its exchange rate. The baht was undone by its link to the dollar, which was appreciating against the yen, dragging the baht up along with it. The overvalued baht led to a huge current-account deficit (Thailand trades mainly with Japan) that had to be financed with an equally large inflow of funds from the rest of the world. When these flows dried up, Thailand had to devalue the baht (in this case, let it float) in order to make Thai exports cheaper and imports more expensive and correct the current account. Because they involve the flight of large amounts of liquidity from a country, resulting in an increase in bad loans, currency crises and banking crises often go hand-in-hand. Consequently, as is the case for all exchange-rate regimes, a well-supervised and regulated financial system is essential. B. Benefits and Drawbacks; Credibility and Reserves A fixed exchange rate reduces the currency risk of international trade and investment. This has a special attraction for Canada, which conducts most of its business with the U.S. Where the rate is constant and investors are confident it will remain constant, there is no need to insure against changes in the exchange rate by hedging. This also makes it easier for investors, businesses and policymakers to forecast and plan. Symbolically, fixing a country’s exchange rate to a low-inflation currency can also signal a government’s commitment to achieving and maintaining low inflation, especially for a country seeking rapid disinflation following a period of hyperinflation. In order to make a fixed exchange rate work, a country must maintain a strong commitment to the fixed rate even in the face of external shocks and pressures to float. It must also have adequate reserves with which to defend the currency from a speculative attack. This credibility, backed up by adequate reserves and a commitment to strong monetary and fiscal policies, is designed to convince investors that there is no reason to attack the currency, which, in the event of a speculative attack, can and will be defended by the central bank. A fixed exchange-rate regime is vulnerable to currency crisis because it allows speculators to make one-way bets against it; as one economist has noted, the average of stable and down is down. Adequate currency reserves are important for making a fixed exchange rate regime credible. In the face of persistent current-account deficits, speculators, sensing that a devaluation to make exports less expensive and imports more expensive might be in the offing, will sell the currency, and try to knock it off its peg. If a country has sufficient foreign reserves, it can attempt to "punish" those who bet against the currency by spending reserves to support it. For instance, China’s $140 billion-plus in foreign reserves sends a clear signal to speculators that it will not be pressured into devaluing its currency. As an aside, while many countries measure the size of their reserves against the level of imported goods, experience suggests they should be measured against the potential selling of assets in a crisis. Reserves themselves come with a cost. First, defending the currency is costly—it is equivalent to exporting money out of the country—and there is always the possibility of devaluation should the speculators deplete reserves or make it too costly to maintain the fixed rate. Second, holding reserves means diverting export earnings into relatively low-yield investments (usually American treasury bills), reducing domestic consumption and investment. Additionally, the government must pay a higher rate of interest on the domestic bonds it sells to acquire the currency that it receives for its (low-yield) reserves. However, different investment strategies can lower the cost of reserves. Building up reserves takes time, although borrowing abroad with longer-term maturities and investing these funds in liquid international securities (an approach taken by China) can cut this time down. Building reserves can also be quite costly, given the spread between payments on long-term bonds and what could be earned through investing in U.S. treasury bills; however, this cost must be measured against the benefit of having the reserves. As well, an increase in reserves often lowers the cost of private debt and equity capital.(6) Moreover, though governments can build credibility through policies and high levels of reserves, absolute credibility is never possible under a fixed-rate regime. The possibility that the government could devalue the currency is enough to leave some doubt in investors’ minds—the lower the perceived credibility, the greater the doubt. For the same reason that intermediate regimes have become suspect, so have less-than-credible fixed-rate regimes; in reality, if a government adopts a less-than-credible fixed-rate regime, it is actually pursuing a de facto intermediate, loosely targeted exchange-rate regime, which has the same problems as an intermediate regime (discussed below). In the words of one observer,

Policymakers who choose a fixed-rate regime sacrifice monetary independence—that is, the ability to introduce monetary stimulus to enhance domestic demand in order to counter an economic downturn. If this monetary stimulus has the short-run effect of lowering interest rates, investors’ incentives to hold the currency would be reduced and the (fixed) exchange rate could be brought under attack. There are also longer-term consequences that are inconsistent with a fixed exchange rate. Stimulative monetary policy would likely lead to expectations of higher inflation and therefore a lower equilibrium value of the domestic currency. In the longer term, nominal interest rates would increase to incorporate these expectations of currency depreciation. As this suggests, a fixed exchange rate implies constraints on a government’s monetary policy. Inflation, and consequently interest rates, must be held at levels that are consistent with the chosen exchange rate, lending credibility to the government and the exchange rate. Financing a deficit is also more difficult. The monetization of deficits and debt is generally inconsistent with a fixed exchange rate, unless of course the foreign currency to which the domestic currency is fixed is subject to the same kind of policy. Even deficits financed through market debt are problematic. As deficits produce market uncertainty with respect to monetary policy, a risk premium would be required by investors. Thus, even without any change in the stance of monetary policy, the interest rates consistent with a fixed exchange rate must rise. Under a fixed rate, external shocks are borne by changes in prices and wages. However, prices and wages are often relatively inflexible and do not easily move downward. Unionization and labour contracts, for instance, can keep wages from fully adjusting to external shocks. In this case, pressures (disequilibria) can build, leading to a speculative attack on the currency. A country seeking greater policy discipline—that is, wanting to control or reduce wages or prices—could, however, benefit from a fixed exchange-rate regime. As noted above, under such a regime, economic shocks—capital flight, lower productivity, and so on—must be borne by wages and prices. Interest rates must rise to persuade investors to increase their holdings of the currency, reducing domestic demand and constraining wages and prices. Defending the currency can also be expensive. This cost can take the form of an interest rate increase, which makes the currency a more attractive holding for investors but stifles domestic growth, or of currency purchases using international reserves, whereby hard currency is exported out of the country. Even sound fiscal and monetary policies do not eliminate the possibility of a speculative attack on a currency. By their very nature, financial markets are imperfect: actors do not have full knowledge of all conditions. As the experience in Asia showed, investors travel in herds, causing panic to spread (contagion) even to countries with relatively sound policies, with dire consequences. As a result,

In the end, if the chosen exchange rate, and domestic fiscal and monetary policies, are inappropriate, capital flows will eventually force a revaluation of the currency. C. Canada and the United States: Optimum Currency Area? Much of the talk on reforming Canada’s exchange-rate regime has centred on the possibility of a common Canada-U.S. (or North American) currency. Ignoring for the moment the huge political obstacles surrounding such a move, the issue technically hinges on whether Canada and the United States form an optimum currency area (OCA) and specifically on whether the two economies are sufficiently similar to warrant the use of a similar currency. Between 1989 and 1997, interprovincial exports fell from 22.7% to 19.7% of GDP, while international exports rose from 26.1% to 40.2% of GDP; (9) most of Canada’s trade (over 80%) is with the United States. Still, the evidence on the need for currency union is inconclusive. As Royal Bank chief economist John McCallum remarks, the exchange-rate volatility associated with a floating currency should in theory impede trade, as firms must hedge their currency purchases. A common currency would therefore reduce exchange-rate risk and increase trade. In seeming contradiction, however, Canada-U.S. trade has exploded in the 1990s, an era of high exchange-rate volatility.(10) At the same time, Canada depends more on commodity exports than does the U.S. (they currently account for 40% of total Canadian exports), suggesting that the structure of the Canadian and U.S. economies are not compatible enough for currency integration. It is, however, true that some regions within Canada are more closely linked with the U.S. than with each other—Ontario and Quebec with the Great Lakes states and British Columbia with the Pacific Northwest, for instance. For a more detailed discussion of the pros and cons of monetary union, the reader is again referred to the paper by Peter Berg. It should be noted, however, that any currency union is as much a political question as an economic one; in fact, Benjamin Cohen remarks that countries have always chosen currency union (not, it should be noted, dollarization or currency adoption) for political reasons.(11) D. Special Case: Currency Boards The desire to maintain credibility in fixed exchange rates has led some countries to consider setting up currency boards, which can serve as a strong sign of a commitment to an anti-inflationary policy. Historically, currency boards have existed in over 60 countries; currently, 14 countries use them. Of the larger countries, Hong Kong has used one since 1983 and Argentina since 1991. In Argentina’s case, the currency board helped the government tame hyperinflation.(12) A currency board fixes the exchange rate of the domestic currency, supposedly forever, against a foreign reserve or a basket of several reserves, and makes it defensible by holding foreign-currency reserves worth at least 100% of a narrow definition of domestic currency. Hong Kong and Argentina hold US$1 for every unit of local currency distributed as cash or as reserves in the commercial banks; one can exchange the local currency for the reserve currency. By definition, then, the country can never run out of reserves. The domestic money supply responds to the balance of payments: when foreign currency flows into the country, the money supply (and reserves) expand; when it flows out, the domestic money supply (and reserves) drop. A drop in reserves would force the board to reduce the money supply and raise interest rates until the rate was attractive enough to lure back investors. The three main advantages of a currency board are credibility (due to high reserves and policy rigidity), low inflation, and lower interest rates (as the currency would be seen as being more stable). A currency board also allows the country to capture most of the seignorage—the interest that accrues to a government from issuing currency interest-free—from issuing money in the home country, since the board holds most of its foreign reserves in marketable securities. An important difference between a currency board and a central bank is that the board does not function as a lender of last resort for troubled domestic financial institutions (though Hong Kong’s holding of reserves greater than 100% of domestic currency gives it some leeway to do so). Choosing to help a troubled bank by printing more domestic money reduces the proportion of foreign reserves held against the domestic currency. This leaves a hole permitting speculators to bet against the currency, as it is no longer backed up 100%. The spectre of devaluation enters the picture. The price of credibility again is the absolute abandonment of the use of monetary policy, even during downswings in the economy. (Even then, there is always some possibility of abandoning the peg—absolute certainty about a country’s actions is never possible.) A properly functioning currency board acts as a "straightjacket" on monetary and fiscal policy—government deficits can no longer be financed by printing money and must be supported by selling government securities; interest rates cannot be used to stimulate the economy; and adjustments would have to come by wage and price changes.

Not only is a board unable to lower interest rates to stimulate a stagnant economy, a drop in the foreign exchange reserves would force it to reduce the domestic money supply and raise interest rates, until these were high enough to persuade people to stop selling the currency. "In principle (though), this self-regulating mechanism discourages speculators, so the interest rates need never rise to high levels." Confidence would drop if investors felt that the board was unwilling to let interest rates keep rising as reserves dropped.(14) E. Special Case: Adoption of Currency One proposal for solving the exchange-rate volatility of Canada’s floating dollar has been for the U.S. dollar to become legal tender in Canada. The same idea has been circulating throughout Latin and South America; smaller countries, such as Panama, already use the U.S. dollar as legal tender. Argentine President Carlos Menem has proposed moving from the use of a currency board to full dollarization.(15) As Courchene and Harris point out, dollarization can come in two forms, market dollarization (the adoption of the dollar by the private sector) and policy dollarization (the adoption of the dollar by the government). In practice, currency adoption (dollarization for those countries that would use the U.S. dollar) is an extreme form of a fixed exchange-rate regime. The argument for dollarization is brief: by surrendering its independent monetary policy a (small) country would no longer have to worry about extreme exchange rate fluctuations and investors would be assured that the currency could never be devalued. Currency adoption would also act as an anchor for monetary stability, as the country would no longer be able to print money. The country would benefit from lower costs for its transactions with the larger country, as hedging and currency conversion would no longer be needed. Theoretically this should increase trade and integration, promoting longer-term integration; nor would reserves be needed. This outcome, however, would come at the cost of monetary and exchange-rate policy independence; the domestic economy would be dependent on a foreign central bank over which it had no influence. As well, a country’s currency is a potent symbol of nationhood and a decision to eliminate it would be politically difficult, at best. Creating a yen zone among Asian economies, for example, would entail a degree of co-operation and surrender of sovereignty that is not at present possible. Adoption of the U.S. dollar by Canada would almost certainly be subject to an intense public debate. Removing the need to print money would also eliminate the central bank and would probably entail the creation of another lender of last resort, though one without the ability to print money. This option would be most likely considered by a country with an abiding fear of hyperinflation, or by a small, open-economy country that was adversely affected by exchange rate fluctuations and that was already deeply integrated with the foreign country whose currency it would adopt.(16) The polar opposite of exchange-rate fixity is exchange-rate flexibility. Under a floating exchange regime, the rate is determined by the supply and demand for a country’s currency. Since the mid-1970s, the number of countries with flexible exchange rates has increased steadily; following the Asian crisis, many economists have suggested that the general failure of many Asian countries to defend their exchange rates necessitates a greater move toward floating.(17) However, as with fixed exchange rates, floating exchange rates have both their positive and negative sides, and a floating exchange rate regime is not suitable for every country. Canada has used a floating exchange rate since 1970. At present, the Bank of Canada conducts monetary policy to keep inflation between 1% and 3%. In practice, this is done through changing interest rates in response to fluctuations in the market. Additionally, the Bank judges the stance of monetary policy by using the Monetary Conditions Index, which takes into account changes in the external value of the dollar. The Bank will often react to a decline in this value by increasing interest rates, not so much to support the dollar but to keep the degree of monetary stimulus consistent with the inflation targets. Nevertheless, the Bank will sometimes try temporarily to support the external value of the Canadian dollar if it feels that markets are unruly. Proponents of a floating exchange rate argue that one of its most important advantages is that it allows an economy to absorb both foreign and domestic shocks more easily, acting as a safety valve. While, under a fixed regime, external shocks affect wages and prices, a floating currency rises and falls in response to changing economic conditions, such as capital flows or economic downturns. Floating rates also allow for monetary independence and therefore more flexible macroeconomic policy; governments can use interest rates to stimulate or dampen the economy without having to worry about defending a particular exchange rate. In Canada, supporters of a flexible rate, such as Governor of the Bank of Canada Gordon Thiessen, contend that it has allowed the Canadian economy to absorb external shocks, such as the Asian financial crisis, though fluctuations in the exchange rates, rather than through more disruptive changes to output, employment and prices. Floating rates help a resource-based economy adjust to fluctuations in resource prices. On the other hand, a floating exchange rate is also susceptible to high volatility and overshooting. In a world of perfect information, the exchange rate would perfectly reflect the value of the currency; if a country became less productive, its exchange rate would drop to reflect this change. Unfortunately, this notion is not borne out by experience. In the 1980s, for example, the excessive movement in the U.S. dollar against the Japanese yen was not matched by any fundamental changes in the real U.S. or Japanese economies. These variations are the result of imperfect information in the financial markets—that is, traders reacting to rumours, to what they think will be the consequence of a just-announced policy decision. Investors also have a tendency to travel in herds, with less-competent investors following the lead of those that are more competent, leading to overshooting in the exchange rate. As the Asian crisis has demonstrated, defending a currency is a costly, risky, and not always successful proposition. To return to Thailand, the run on its currency was so severe it knocked the baht from its peg and forced the government to let the currency float. This came about because the baht was tied to the U.S. dollar and got dragged upward against the yen, the result of economic conditions that had nothing to do with Thailand. This underlines the danger of inappropriate linkages between currencies. Theoretically, under a floating exchange-rate regime, the baht could have responded to the appropriate market signals, with authorities simply letting the baht drop as far as the market required. More positively, letting the market determine the exchange rate greatly reduces the need for a country to intervene in the foreign exchange market to defend its exchange rate. (In practice, even countries with floating exchange rates typically keep reserves on hand to cope with short-term liquidity crises that could arise out of, for instance, having a short-term debt exceeded by foreign currency reserves, speculator panic or contagion.) Floating exchange rates also explicitly introduce two-way risk. Under fixed exchange rates, it is assumed that, since the rate is always fixed, there is no foreign currency risk. Thus, investors are lulled into thinking that there is no need to hedge against a possible devaluation. If, however, the fixed rate does change (as in Thailand), businesses can be left with unhedged loans and obligations. With floating exchange rates, businesses and investors must explicitly hedge their currency purchases. The exchange rate acts as a signal to help allocate global capital to its most productive uses. For example, if Mexican business investment became more profitable, foreign investors would buy more pesos, thereby strengthening the peso. Imports would rise because they would be less expensive, and exports would fall because they were more expensive. If business became less profitable, investors would sell pesos and head elsewhere, and the currency would drop.(18) In this way, floating exchange rates can help prevent the accumulation of excessive foreign currency liquidity mismatches and unhedged exposure to foreign currency. Real exchange rates are substantially more volatile under a floating exchange-rate regime than under a fixed rate, because of the movement of the nominal exchange rate. Exchange rates can become highly unstable, especially if large amounts of capital flow in and out of a small country. In a small emerging market, a shock to one bank or one fund could set the exchange rate off, to the detriment of the rest of the economy. Faced with a declining exchange rate, investors can lose faith in a currency, making it harder to fight inflation. For all countries, large and small, excessive volatility can also act as a restraint on capital movement because it makes it more difficult for economic actors to plan and anticipate the future. Misalignment is one consequence of this volatility. By overshooting or undershooting, the exchange rate suggested by an economy’s fundamentals can be shifted for periods longer than two years. Canada’s current low dollar and its dollar worth 89 cents U.S. in the late 1980s are two examples of misalignment.(19) Misalignment brings with it real costs. If a currency is undervalued, foreign debts, denominated in other currencies, will be greater (as will be the cost of servicing these debts) and inflation will be higher. If the currency is overvalued, export prices will be higher than they should be, hurting competitiveness, reducing exports and upsetting the trade balance. The Canadian dollar’s appreciation after the FTA came into effect increased the adjustment costs of Canadian industry. By keeping exports competitive, an undervalued currency reduces the need for firms to undertake the productivity improvements that would increase their longer-term competitiveness. While a flexible regime will not face the same pressure to devalue as a fixed-rate regime, it does face the possibility of a long-term devaluation. Indeed, the general devaluation of the Canadian dollar since the mid-1970s has led some economists to suggest that a flexible exchange rate is no longer suitable for Canada, which should therefore switch to some sort of fixed rate; others believe that such a problem is best dealt with through policy changes and does not really fit the definition of a crisis.(20) C. Which Countries Should Use Floating Rates? Traditionally, floating exchange rates have worked best for larger countries with relatively more trade within their borders than over their borders, countries that are less likely to be affected by sharp swings in the exchange rate. Such countries, of which the United States is one, generally benefit from a floating exchange rate.(21) The corollary to this statement is that small countries open to trade that is dependent on investment flows can be harmed by sharp swings in the exchange rates. In a small market with open capital flows and a poorly developed capital market, in which investors cannot choose between different kinds of securities, the main asset price is the exchange rate, which can be moved around dramatically as capital flows into and out. However, the exchange rate also has an effect on the real economy, the production of goods and services; instability in the exchange rate can thus translate into instability in the real economy. A government wanting to stop a capital outflow that could cause its currency to collapse must drastically raise interest rates to persuade investors to stay. The "impossible trinity" principle suggests that small, open countries wishing to use a floating exchange rate should consider implementing some form of capital controls. These would also come with a cost, however; see "Global Capital Flows: Out of Control," a paper prepared by Peter Berg of the Parliamentary Research Branch in 1998 for the Standing Senate Committee on Foreign Affairs. Intermediate exchange rate systems are a compromise between fixed and floating exchange-rate regimes. They attempt to combine the stability of a fixed rate with the monetary policy independence of a floating regime. Generally, some fluctuation is allowed, within a predetermined band, against a currency or a basket of currencies, which is itself adjusted on a regular basis; depending on the degree of fixity desired, the target (or target band) can be allowed to move as well. Increasing financial integration among countries and failures in the intermediate systems used in Russia, East Asia, Brazil and Mexico have caused these systems to fall increasingly into disfavour; many economists now insist that the only real options are either to fix irretrievably or to float. One sceptical economist describes managed floating of a currency (intervention only to smooth out random fluctuations and short-term supply/demand mismatching) as "an old combination of nice-sounding words rather than a concrete combination of coherent institutions and policies."(22) One appeal of intermediate pegs is that they allow governments to adjust their exchange rates (or exchange rate bands) in response to changing economic circumstances. One concern arises because this form of adjustable peg exposes exchange rates to one-way bets. If it is clear to government officials that the peg or band needs to be modified, it will also be clear to the markets, leading to a possible attack on the currency. Again, defence of the currency entails costs, either in the form of higher interest rates or the exportation of foreign-exchange reserves. Transparency is also an issue. It is more difficult for investors to evaluate what governments will do under an intermediate regime than under the relatively straightforward fixed or floating regimes. It should be asked whether investors will react better to simple rules than to more complex ones.(23) The negative comments on intermediate systems do not mean that such systems are not being considered. C. Fred Bergsten, Director of the Institute for International Economics, summarizes the problem as such:

He suggests a managed float with allowable fluctuations of up to 15% on each side of a predetermined midpoint. Long-run disequilibria could be avoided by minute changes in the endpoints, similar to a crawling band. Under this plan, the G-7 nations could coordinate monetary policy in order to minimize exchange rate volatility within a band large enough to accommodate cyclical changes in the economy.

Such approaches do not seem to address the concerns raised above and are perhaps simply modified intermediate solutions that would be prone to the same problems. However, it should be asked whether these systems—fixed, floating or mixed—can minimize or eliminate excessive fluctuations and currency crises. If it is impossible to eliminate currency speculation, as seems to be the case in all but a one-currency world, the question becomes simply which approach can minimize exchange volatility.

The choice of an appropriate exchange-rate regime remains a difficult policy question, though it bears repeating that any exchange-rate regime can be undermined by unsound monetary and fiscal policy. Although some generalizations can be made (no one exchange-rate regime is appropriate for all countries at all times; larger countries should float; small open countries should fix), even these rules are not written in stone; a close examination must be made of the pros and cons of each regime as it applies to a specific country and including attention to the costs involved in a transition to a new exchange rate set-up. Even then, as Canada’s situation demonstrates, the large number of interacting variables in an economy mean that it is never possible to say definitively that one exchange-rate regime is unequivocally superior to another; those who favour fixed or floating exchange rates can all marshal convincing arguments to their cause. About the only possible conclusion is that, in a world of multiple currencies, exchange rate crises and different responses to these crises will persist. Berg, Peter. A Common Currency between Canada and the United States: Key Arguments for and against. Paper prepared for the Standing Senate Committee on Banking, Trade and Commerce. 3 March 1999. Cohen, Benjamin J. Monetary Union: The Political Dimension. Paper presented at the symposium "Should Canada and the U.S. Adopt a Common Currency?" Western Washington University, 30 April 1999. http://www.cbe.wwu.edu/cib/papers/cohen.PDF Courchene, Thomas J. and Richard G. Harris. From Fixing to Monetary Union: Options for North American Currency Integration. C.D. Howe Institute, Toronto, June 1999. http://www.cdhowe.org Courchene, Thomas J. Towards a North American Common Currency: An Optimal Currency Area Analysis. Paper prepared for the Sixth Bell Canada Papers Conference: "Room to Manoeuvre? Globalization and Policy Convergence," Queen’s University, 5-6 November 1998. Enoch, Charles

and Anne-Marie Gulde. "Are Currency Boards a Cure for All Monetary Problems?" Finance

and Development, December 1998. Fedelstein, Martin. "A Self-Help Guide for Emerging Markets." Foreign Affairs 78:2, March-April 1999, p. 93-109. Frankel, Jeffrey A. "The International Financial Architecture." Brookings Institute, Policy Brief #51, June 1999. http://www.brook.edu/comm/policybriefs/pb051/pb51.htm McCallum, John. "Seven Issues in the Choice of Exchange Rate Regime for Canada." Current Analysis. Royal Bank, February 1999. http://www.royalbank.com/economics/market/index.html. Yeager, Leland B. "How to Avoid International Financial Crises." CATO Journal 17:3, Winter 1998. http://www.cato.org/pubs/journal/cj17n3.html (1) The exchange rate is the price paid in one currency for the money of another country. In order to purchase goods and services, or to invest in a foreign country, one usually needs to purchase that country’s currency. Its cost in terms of the home currency is the exchange rate. Demand for a country’s output (including investment) pushes its exchange rate up. Currency can also be purchased for speculative purposes, with investors buying and selling a currency according to expectations of movements in the exchange rate. Expectations often drive exchange rates, causing large fluctuations. (2) In fact, the International Monetary Fund’s handling of recent crises has been criticized for its insistence that countries in crisis adopt a fixed-rate approach. (3) Jeffrey E. Garten, "Lessons for the Next Financial Crisis," Foreign Affairs, 78:2, March-April 1999, p. 89. (4) These are the most basic criteria. OCA literature has added several possible qualifications, including similar inflation rates, political viability, and the degree of commodity diversification. (5) Jeffrey A. Frankel, "The International Financial Architecture," Brookings Institute, Policy Brief #51, June 1999. http://www.brook.edu/comm/policybriefs/pb051/pb51.htm (6) Martin Fedelstein, "A Self-Help Guide for Emerging Markets," Foreign Affairs 78:2, March-April 1999, p. 103. (7) Garten (1999), p. 89. (8) C. Fred Bergsten, "Alternative Exchange Rate Systems and Reform of the International Financial Architecture," testimony before the Committee on Banking and Financial Services, U.S. House of Representatives, 21 May 1999. http://www.iie.com/TESTMONY/fred5-21.htm (9) Quoted in Thomas J. Courchene and Richard G. Harris, From Fixing to Monetary Union: Options for North American Currency Integration, C.D. Howe Institute, Toronto, June 1999, p. 27n. (10) John McCallum, "Seven Issues in the Choice of Exchange Rate Regime for Canada," Current Analysis, Royal Bank, February 1999, p. 3. http://www.royalbank.com/economics/market/index.html (11) Benjamin J. Cohen, Monetary Union: The Political Dimension, paper presented at the symposium "Should Canada and the U.S. Adopt a Common Currency?" Western Washington University, 30 April 1999. http://www.cbe.wwu.edu/cib/papers/cohen.PDF (12) Charles Enoch and Anne-Marie Gulde, "Are Currency Boards a Cure for All Monetary Problems?" Finance and Development, December 1998, p. 40. (13) Thomas J. Courchene, "Towards a North American Common Currency: An Optimal Currency Area Analysis" (Conference version), Sixth Bell Canada Papers Conference, Queen’s University, 5-6 November 1998, p. 42. (14) Fedelstein (1999), p. 107. (15) Courchene and Harris (1999), p. 25. (16) Bergsten (1999). (17) "Fix or Float?" Global Financial Survey, The Economist, 30 January 1999, p. 15. (18) Fedelstein (1999), p. 95-96. (19) Courchene and Harris (1999), p. 5. (20) Leland B. Yeager, "How to Avoid International Financial Crises," CATO Journal 17:3, Winter 1998. http://www.cato.org/pubs/journal/cj17n3.html (21) Frankel (1999). (22) Yeager (1999). (23) Frankel (1999). (24) Bergsten (1999). (25) Frankel (1999). |