95-2E

THE CANADA HEALTH AND SOCIAL TRANSFER:

OPERATION AND POSSIBLE REPERCUSSIONS

ON THE HEALTH CARE SECTOR

Prepared by:

Odette Madore

Economics Division

Revised 3 June 2003

TABLE OF CONTENTS

A. Transfers Under

Established Programs Financing and the Canada Assistance Plan:

A Brief Background

1. Established Programs Financing

B. The Canada Health and Social Transfer: Its Nature and Operation

C. Consequences of the Canada Health and Social Transfer

1. Provincial Public Finances and Provincial Expenditures for Health Care

2. The Canada Health and Social Transfer and the Canada Health Act

THE CANADA HEALTH AND SOCIAL TRANSFER:

OPERATION AND POSSIBLE REPERCUSSIONS

ON THE HEALTH CARE SECTOR*

For more than four decades, the federal government has used transfer payments to help the provinces carry out their responsibilities in terms of health care, post-secondary education and public assistance. Before 1996‑1997, transfers for health care and post-secondary education were made under the Federal-Provincial Fiscal Arrangements and Federal Post-Secondary Education and Health Contributions Act, generally referred to as Established Programs Financing (EPF), while transfers for welfare and social assistance services were made under the Canada Assistance Plan (CAP). Federal contributions to EPF and CAP were considerable. According to Department of Finance documents, EPF transfer payments amounted to $22.0 billion in 1995-1996, while transfers under CAP accounted for approximately $7.9 billion.

In 1995, the federal government decided to bring EPF and CAP transfers together under a single financing mechanism: the Canada Health and Social Transfer (CHST). Bill C-76, which created the new block transfer, was assented to on 22 June 1995, and the CHST came into force in 1996-1997. It was felt that the CHST would give the provinces more discretion over how funds were to be divided among health care and other social programs. More provincial flexibility, however, has led to reduced federal visibility and transparency in these fields and diminished provincial accountability for how federal transfers are spent. For these reasons, in 2003 the federal government enacted Bill C-28, which divides the CHST into two distinct transfers: one for health care and one for social programs.

This paper examines the overall operation of the CHST and attempts to assess its possible repercussions, primarily in the health care area. The first part of the paper reviews the background and operation of EPF and CAP, and the second part describes the nature and general operation of the CHST. The third and last part analyzes the implications of the CHST for public finances at the provincial level, provincial health care expenditures, and federal government enforcement of the Canada Health Act.

A. Transfers

under Established Programs Financing and the Canada Assistance Plan:

A

Brief Background

Federal and provincial responsibilities for health care, post-secondary education and public assistance are quite different. Under Canada’s Constitution, the three areas of health care, education and social programs are primarily matters of provincial jurisdiction, and the provinces are responsible for their delivery. By invoking its constitutional “spending power,” the federal government has intervened in those areas, leading to the making of federal transfer payments to the provinces. The transfers make it possible to redress the constitutional imbalance between provincial taxing powers, which are more limited than those of the federal government, and provincial responsibilities, which are often onerous. Federal transfers also improve fairness between the provinces in terms of the level of services offered to the public.

1. Established Programs Financing

The EPF, which came into force on 1 April 1977, was the largest federal transfer program to the provinces. Under the program, each province received an equal per capita transfer for health care insurance (including hospitalization, medical care and extended health care services) and post-secondary education. About 70% of all EPF transfers were earmarked for the “health” component, while the remaining 30% went to the “education” component. This breakdown was arbitrary, because EPF was a “block” funding mechanism. Unlike shared-cost programs, EPF transfers were not determined on the basis of the provinces’ own expenditures on health care and education. Furthermore, these percentages did not necessarily reflect equal apportionment at the provincial level, because provinces were able to use EPF transfers according to their own priorities.

Originally, the basic payment under EPF was calculated on an initial per capita amount, determined in 1975-1976, which was then adjusted each year, according to an escalator that took into consideration per capita rate of growth in the GDP. To determine the total value of a province’s EPF entitlement, the initial amount was multiplied by the escalator and then by the population of that province.

The escalator was modified on several occasions from the mid-1980s to the mid‑1990s. In 1983-1984 and 1984-1985, the escalator associated with EPF education was capped at 6% and 5% respectively (if the formula based on the growth in the GDP per capita had been used, EPF‑education amounts would have increased by 9% in 1983-1984 and by 8% in 1984-1985). For all other years, the escalator for post-secondary education was the same as for health care insurance. From 1986-1987 to 1989-1990, the escalator used to calculate total EPF payments was reduced by 2%. After this period, and until 1994-1995, per capita transfers were frozen at their 1989-1990 levels, so that the total amount of transfer payments increased only in accordance with population growth in each province (about 1%). For 1995-1996, the escalator was decreased by 3% and the result was a negative escalator (almost -1.0%, according to the Federal-Provincial Relations Division of the Department of Finance); this meant a decrease in per capita transfers, given the fact that GDP growth was less than 3%.

EPF total transfers, or entitlements, had two components: a tax transfer and a cash transfer. Cash transfers to the provinces corresponded to monetary or financial contributions that were made periodically by cheque; in addition, the federal government accorded a certain tax room to the provinces through the transfer of tax points. To do this, the federal government reduced its tax rates while the provinces increased their rates by an equivalent amount. This procedure resulted in a reallocation of revenue between the two levels of government: federal revenue was reduced by an amount equivalent to the increase in the provincial governments’ revenues. The fiscal burden on taxpayers remained the same because, although they paid more provincial tax, they paid less federal tax.

Under EPF, the federal tax transfer was 13.5 tax points on personal income tax and one tax point on corporate income tax. The provinces whose fiscal strength was lower than a provincial standard received equalization payments to bring their transfer up to that standard (the provinces making up the standard are Quebec, Ontario, Manitoba, Saskatchewan and British Columbia). The cash transfer corresponded to the difference between the total EPF entitlement of each province and the value of the tax transfer. As part of its opting-out agreements, Quebec received a special abatement of 8.5 additional tax points on personal income. Because of this additional abatement, Quebec received a relatively larger share of its federal contribution than the other provinces in the form of transferred tax points and a smaller share in the form of cash. In total, however, Quebec’s per capita entitlement under EPF was exactly the same as those of other provinces.

The federal government did not impose any specific condition on the provinces regarding the proportion of transfers to be devoted to post-secondary education. The provinces, however, had to comply with the requirements set out in the Canada Health Act (CHA) –universality, accessibility, comprehensiveness, portability, public administration and the non‑imposition of user fees and extra-billing – or be subject to financial penalties.

Until 1991-1992, penalties for failure to comply with the CHA were applied only against cash transfers for EPF-Health; however, they were later also applied against other provincial entitlements. This extension of financial penalties to cash transfers under other federal programs was made necessary by the continual limitations placed on the growth rate of EPF transfers and the particular effects of such restrictions on the cash transfers; it was estimated that EPF-Health cash transfers to some provinces would have reached zero by the end of the century. Without the cash transfer, the federal government would no longer have had the power to enforce the CHA’s requirements.

Created in 1966, the Canada Assistance Plan had two primary objectives with respect to persons in need: to assist the provinces in providing welfare services and social assistance and care in appropriate facilities; and to ensure services in order to lessen, eliminate or prevent the causes and effects of poverty, child neglect and dependence on public assistance. The Plan had the following components:

General assistance: Assistance for meeting basic needs: food, accommodation, clothing and so on; the greater part of CAP expenditures.

Special care facilities: Care provided to people living in old age homes, rest homes and other kinds of facilities defined in the agreements.

Health care: Health costs such as medication and dental services not covered under provincial health care plans.

Child protection: Cost of maintaining children placed in foster homes.

Welfare services: Child care, adoption, rehabilitation and community development.

Work adjustment programs: Projects for persons having difficulty in obtaining or keeping a job for personal or family reasons.

CAP was a shared-cost program: the federal government refunded approximately 50% of the eligible costs incurred by the provinces. The growth in contributions made under CAP thus varied directly with the provincial expenditures on public assistance. CAP involved cash transfers only, except in the case of Quebec, which received a special five-point tax abatement on personal income. Under the CAP agreements, the federal government set certain conditions. For example, the provinces had to include a right of appeal in their social assistance legislation and could not restrict eligibility by imposing a provincial residency requirement.

The provinces were responsible for the design, eligibility criteria and administration of public assistance programs. To obtain their share of funds, however, they had to prove that their programs and services met the Plan’s requirements; provincial claims could be challenged if the federal government believed that the funds were spent in ways that did not meet the criteria set out in the agreements. For example, the Government of British Columbia decided to impose, starting on 1 December 1995, a three-month residency requirement before individuals could receive social assistance. That same month, the Honourable Lloyd Axworthy, federal Minister then responsible for CAP, announced that CAP transfer payments to British Columbia would be reduced by $47.1 million because that province had limited eligibility for this program.

From the beginning of the Plan’s operation until 1990-1991, CAP transfers were open-ended; the federal government kept pace with whatever the provinces decided to spend and transfers were accordingly not subject to any limits. In 1990-1991, the federal government placed a ceiling on financing, usually called the “cap on CAP.” More specifically, a 5% limit for 1990-1991 and 1991-1992 was placed on annual increases in the contributions made to the three provinces that received no equalization payments (Alberta, British Columbia and Ontario); the other provinces were not subject to any limit. In February 1991, the federal government decided to extend the ceiling until 1994-1995. Then, in its February 1994 budget, for 1995-1996 it froze at their 1994‑1995 levels the amounts paid under CAP to all provinces.

B. The Canada Health and Social Transfer: Its Nature and Operation

In the Budget Speech of February 1995, the federal government announced the new block transfer merging EPF with CAP. Budget documents stated that block funding awarded under the CHST would give the provinces more discretion over how funds were to be divided among health care, post-secondary education and public assistance. The Budget Implementation Act, 1995 (Bill C-76), which was assented to on 22 June 1995, created the new transfer. The Act specified the amount of the CHST and its breakdown by province for the 1996-1997 fiscal year. Since then, the Federal-Provincial Fiscal Arrangements Act, which now governs the CHST, has been modified on six different occasions by the following pieces of legislation: Bill C-31 (1996); Bill C-28 (1998); Bill C-71 (1999); Bill C-32 (2000); Bill C-45 (2000) and Bill C-28 (2003). The section below entitled “Chronology” provides a historical review of the various legislative steps for the CHST. In this section, the operation of the CHST in relation to these bills is examined in terms of the following characteristics: total entitlement determination, provincial allocation formula, cash and tax structure, and cash floor provision.

Under Bill C-76 and Bill C-31, the total CHST entitlement was set at $26.9 billion in 1996-1997, and $25.1 billion for each fiscal year from 1997-1998 through 1999-2000. For eachsubsequent fiscal year, through 2002-2003, the total CHST entitlement was set to increase according to an escalator equal to the average GDP growth for the three preceding years, less a predetermined coefficient. Bill C-71, Bill C-32, Bill C-45 and Bill C-28 provided additional cash transfers; this ensured that the total CHST would grow in line with both the cash and the tax transfers rather than being set at a fixed level in the legislation.

The Act governing the CHST also establishes the method of allocating the transfer to the provinces. Under Bill C-76, the provinces were to receive their share of the transfers under CAP in 1994-1995 and under EPF in 1995-1996. Then, under Bill C-31, the provincial allocation formula was modified to reflect both the provincial share in 1996-1997 and the province’s demographic weight within Canada as a whole; this ensured that the total CHST entitlement would gradually move towards equal per capita entitlements across provinces. Bill C‑71 accelerated the move to equal per capita CHST. As a result, in 2001-2002, all provinces received identical per capita CHST entitlements. However, the CHST cash transfer, per capita, continuedto vary from province to province. Provinces with higher income generated more of their entitlement from their tax transfer, while the others receivedmore in the form of cash transfer to bring their entitlements up to the national average.

The CHST is similar in structure to EPF: it includes a tax points transfer and a cash transfer. As indicated above, the tax points transfer is 13.5 tax points on personal income tax and one tax point on corporate income tax. Quebec’s special abatement of tax points remains and, as was previously the case, reduces the cash component of the transfer by an equivalent amount. As well, as was the case in the past, provinces whose fiscal strength is lower than the provincial standard receive equalization payments to bring their tax transfer payments up to that standard.

Unlike EPF, however, the CHST legislation (Bill C-31) specifically guaranteed, for a number of fiscal years, a floor for the cash transfer. The purpose of this floor was to provide protection against unexpected economic fluctuations that might reduce the total entitlement or significantly increase the value of the tax transfer, leading to a decrease in cash transfers to the provinces. Initially, this floor was set to be no less than $11 billion. Bill C‑28, assented to on 18 June 1998, raised the floor to $12.5 billion for 1997-1998 and beyond. The cash floor provision of the CHST was abolished in 1999 as the amended legislation (Bill C‑71) provided a level of cash transfer over and above the $12.5-billion limit. Many commentators argue that, unlike the EPF, which aroused fears that the cash transfers might reach zero, the CHST ensures that a monetary contribution will be made to the provinces and thereby preserves the federal government’s power to mandate compliance with the Canada Health Act.

Bill C-28, which was enacted in 2003, also provides additional cash transfers for the CHST. Perhaps most importantly, this legislation puts an end to the CHST by dividing it into two distinct transfers – the Canada Health Transfer (CHT) and the Canada Social Transfer (CST). Both the CHT and the CST will take effect in fiscal year 2004-2005. Some 62% of the current CHST tax transfer will be allocated to the CHT, while the remaining 38% will be devoted to the CST. The legislation provides that the cash portion for both the CHT and the CST will be set at a fixed level from 2004-2005 through to 2007‑2008. Therefore, the total entitlement of the two transfers will grow in line with the cash and the tax transfers. Total entitlements will then be allocated among the provinces on an equal per capita basis.

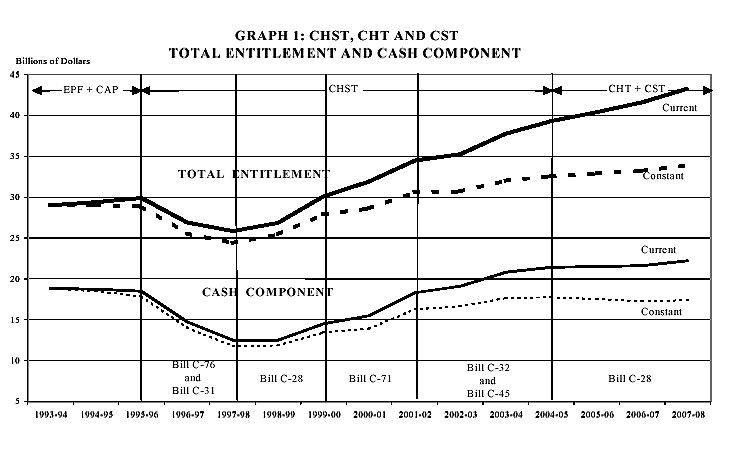

As Graph 1 shows, the coming into force of the CHST legislation led to a significant reduction in total entitlements for the purposes of health care, post-secondary education and social assistance. The impact of that reduction was more than proportionately reflected in the cash component, because the tax transfer continued to grow.

From 1995-1996 to 1996-1997, the total CHST entitlement (expressed in current dollars) decreased by nearly $3 billion, a reduction of almost 10%. In the following fiscal year, the total CHST entitlement was reduced again by $1.1 billion (or 5%). The cash component of the CHST declined even more steeply, by $3.7 billion (or 20%) from 1995-1996 to 1996-1997 and by $2.2 billion (or 15%) from 1996-1997 to 1997-1998. The changes legislated in Bill C‑28 reversed these downward trends, while Bill C‑71, Bill C-32, Bill C-45 and the new Bill C‑28 together led to substantial growth in both the total CHST entitlement and the CHST cash transfer. In 1999-2000, the total CHST entitlement reached its peak level of 1995-1996; the CHST cash component matched its 1993-1994 peak level only in 2002-2003.

However, when converted into constant (1993-1994) dollars, the total CHST entitlement surpassed the 1995-1996 level in 2001-2002, while the CHST cash transfer will never regain its peak level of 1993-1994. In other words, although Bill C-28, Bill C‑71, Bill C-45 and the new Bill C‑28 have resulted in real growth in cash transfers, they have not fully restored the federal cash funding that was provided prior to the creation of the CHST.

Source: Finance Canada and Library of Parliament. The conversion into constant (1993‑1994) dollars was made by using the implicit price index from Statistics Canada. Projections are based on data by TD Economics Forecast.

C. Consequences of the Canada Health and Social Transfer

The CHST was part of the federal efforts to reduce and eliminate the deficit. In introducing the CHST legislation, the federal government explained that transfers to the provinces could be no exception to expenditure reduction: in 1995-1996, transfers to the provinces accounted for nearly one-quarter of all federal program expenditures. The federal government argued that the provinces were in a position to absorb the impact of the cuts, noting that some of them had even balanced their budgets. While acknowledging that the cuts were significant, the federal government pointed out that they were not as severe as cuts made to other federal programs.

According to some observers, the CHST, as initially introduced, was not really an innovation. On the one hand, it followed the policy of restricting expenditures that had been adopted in the 1980s. On the other hand, the CHST legislation did not encourage any new approaches to increasing effectiveness and efficiency in the delivery of health care, even though the lack of effectiveness and efficiency is considered one of the main obstacles to maintaining a publicly funded health care insurance plan across the country.

The increases in the CHST produced by Bill C-71, Bill C-32, Bill C-45 and the new Bill C-28 have reversed the declining trends in federal transfer payments and will result in an increase in provincial revenues. Further, the additional cash transfers provided under the CHST ensure the federal government’s ability to enforce the Canada Health Act.

1. Provincial Public Finances and Provincial Expenditures for Health Care

When it introduced the CHST, the federal government systematically reduced transfer payments to the provinces with the goal of reducing and eliminating its deficit. The provinces did not agree with the federal government’s methods, however. A number of provincial governments argued that the federal government restrictions were inappropriate because provincial entitlements had not caused the federal deficit. Some said that the federal government’s attempt to balance its books by decreasing its contributions to the provinces merely shifted costs from one level of government to another; they argued that it had no practical effect on the effectiveness and efficiency of either the programs offered or the management of the public purse.

The provinces, who were grappling with their own deficits, were forced to revise their priorities in order to compensate for the decrease in income brought about by reductions in federal transfer payments. Most provinces have reduced the level of health care services; a number of them have de-insured certain services and streamlined hospital services.

The increase in the CHST cash transfer under Bill C-71, and, more important, the additional CHST cash transfers provided by Bill C-32, Bill C-45 and Bill C-28, have helped reverse this situation. CHST transfers are now growing steadily, and provinces are devoting more funding to health care in order to alleviate pressures with respect to waiting lists, crowded emergency rooms and diagnostic services.

Although additional CHST funding has been an important step, the provinces feel that it is not enough. In February 2000 and in August 2000, then again in February 2003, provincial governments called on the federal government not only to fully restore the cash component of the CHST, but also to establish an appropriate escalator to ensure that the CHST cash transfer keeps pace with the economic and social factors affecting the sustainability of the health care system. Recent studies, such as Turning the Tide– Saving Medicare for Canadians (July 2000) and On the Road to Recovery (September 2000), even suggested that the growth in the CHST cash transfer be based on a combination of factors including population growth, ageing, epidemiology, cost of health care technology, and economic growth. According to the provincial premiers, an effective reform of health care can take place only when an adequate level of funding has been secured. Bill C-28, which establishes the CHT and the CST, does not contain any provision that would adjust the total entitlement or the cash component according to an escalator.

2. The Canada Health and Social Transfer and the Canada Health Act

The CHST does not make a distinction, not even a theoretical one, among transfers intended for health care, post-secondary education and public assistance. However, the requirements set out in the Canada Health Act continue to apply to provincial public health care insurance plans; these requirements apply to all CHST cash contributions. Under the legislation, the provinces are required, as they were in the past, to provide public assistance without imposing a minimum residency requirement; the cash contribution to a province that did not observe the prohibition against imposing residency periods could be reduced or withheld. The Act governing the CHST even provides that additional requirements could be imposed on other provincial social programs. There are still no specific conditions for post-secondary education.

With regard to health care, a number of analysts feared that the federal government would not be able to ensure provincial compliance with the criteria and conditions of the Canada Health Act. They estimated that if the formula for calculating the CHST continued to be modelled on EPF, the cash component of the transfer would gradually disappear early in the new century. The cash floor provision in the CHST legislation along with the recent additional investment into the CHST have calmed these fears. The federal government has retained its moral authority and political clout, which it was on the verge of losing, to ensure that the provinces comply with the Canada Health Act. The absence of strong requirements for the social programs formerly funded under CAP, however, raises fears of a budget rearrangement at the provincial level. For example, provinces might be tempted to cut their funding for social programs and reallocate the money to the health care system, where there are specific requirements.

The federal government has long participated in the financing of provincial programs for health care, post-secondary education and public assistance. Federal transfers for health care under EPF and application of Canada Health Act criteria and conditions have contributed to the creation of a universal and comprehensive public health care insurance plan in every province. The decrease in federal transfer payments resulting from the introduction of the CHST translated into difficult political and budgetary choices for the provinces with respect to health care, post-secondary education and public assistance. The increases made to the CHST cash transfer since 1998-1999, though quite significant, still do not compensate for the losses in revenue experienced by provincial governments. The provinces are again asking for a fair share of the federal budget surplus through the full restoration and indexation of the CHST or its successors, the CHT and the CST.

22 June 1995 - Bill C-76, establishing the Canada Health and Social Transfer (CHST), received Royal Assent.

-

The total CHST entitlement (including both the cash and tax components) was set at $26.9 billion for 1996-1997 and $25.1 billion for 1997-1998.

-

The cash transfer was obtained by subtracting the value of the tax transfer from the total CHST entitlement. Therefore, the cash transfer was a residual value that varied inversely with the tax transfer.

-

The total CHST entitlement was to be allocated among provinces in the same proportion as allocated under combined EPF and CAP for 1995-1996. This resulted in significant disparities between provinces in terms of per capita CHST entitlements, because the 1995-1996 base year was one in which the cap on CAP was in effect for the non-Equalization receiving provinces.

20 June 1996 - Bill C‑31, establishing the amount and provincial allocation of the CHST for 1997‑1998 through 2002-2003, received Royal Assent.

-

For 1996-1997 and 1997-1998, the total CHST entitlement was maintained at $26.9 billion and $25.1 billion respectively.

-

A five-year CHST funding arrangement was established for subsequent years. For 1998-1999 and 1999-2000, the total CHST entitlement was fixed at $25.1 billion. For each subsequent fiscal year, through 2002-2003, the total CHST entitlement was set to increase according to an escalator equal to the average GDP growth for the three preceding years, less a predetermined coefficient (2% in 2000-2001, 1.5% in 2001‑2002 and 1% in 2002-2003). At the end of the line, growth in the total CHST entitlement would be lower than that of the economy.

-

A floor of $11 billion was established for the cash transfer. The purpose of this floor was to provide protection against unexpected economic fluctuations that could reduce the total entitlement or significantly increase the value of the tax transfer, leading to a decrease in the CHST cash transfer.

-

A new provincial allocation formula was introduced to reflect provincial population growth and to narrow existing funding disparities, moving halfway to equal per capita CHST entitlements by 2002-2003.

18 June 1998 - Bill C-28, raising the floor for the cash portion of the transfer to $12.5 billion, received Royal Assent.

-

The cash floor under the CHST was increased from $11 billion to $12.5 billion for the years 1997-1998 to 2002‑2003. This ensured that a sufficient level of cash transfer was provided to the provinces and territories and thereby preserved the federal government’s power to mandate compliance with the Canada Health Act.

-

This new cash floor provision became operative immediately. As a result, the cash transfer was no longer always determined residually. If the cash floor was a binding constraint, then the total entitlement would vary with changes in the value of the tax transfer.

17 June 1999 - Bill C-71, providing additional CHST cash transfers for the purpose of health care, received Royal Assent.

-

The CHST legislation was extended from 2002-2003 to 2003‑2004. More importantly, the CHST cash transfer was increased by $11.5 billion over five years (1999-2000 to 2003‑2004). The legislation clearly stated that this additional CHST cash transfer was specifically designated for health care purposes.

-

Of this amount, $8 billion was to be provided through increases to the CHST. Another $3.5 billion, allocated on an equal per capita basis, was provided through a Trust Fund from which provinces could draw down funds over three years (1999-2000 to 2001-2002) as they saw fit.

-

The cash floor provision was abolished as the amended legislation provided a level of cash transfer over and above the $12.5-billion limit. Similarly, the escalator used for calculating the growth of the total CHST entitlement was eliminated because the entitlement was not fixed in legislation any more, but varied directly with the cash transfer.

-

The provincial allocation formula was accelerated to move to equal per capita CHST entitlements by 2001-2002.

29 June 2000 - Bill C-32, providing additional CHST cash transfers for the purpose of both health care and post-secondary education, received Royal Assent.

-

A CHST Supplement Fund of $2.5 billion was created for the purpose of funding both health care and post-secondary education. These funds were allocated on an equal per capita basis. Provinces could draw down their respective share at any time over the course of four years. This brought the CHST cash transfer to $15.5 billion for each of the fiscal years from 2000-2001 to 2003-2004.

20 October 2000 - Bill C-45, providing additional CHST cash transfers, received Royal Assent.

-

The CHST legislation was extended by one year to 2005‑2006.

-

The total CHST entitlement was increased by $21.1 billion over a five-year period through an enriched cash transfer provided as follows: $2.8 billion in 2001-2002, $3.6 billion in 2002-2003, $4.3 billion in 2003-2004, $4.9 billion in 2004-2005, and $5.5 billion in 2005-2006. This additional funding was to cover all three fields supported by the CHST, including early child development, and would be allocated to the provinces on an equal per capita basis.

19 June 2003 - Bill C-28, providing additional federal funding for health care and dividing the CHST into two distinct transfers (the Canada Health Transfer, or CHT; and the Canada Social Transfer, or CST) received Royal Assent.

-

A Diagnostic/Medical Equipment Fund is established, separated from the CHST and the CHT, to assist the provinces in enhancing access to publicly funded diagnostic care and treatment services. Cash transfers provided under the Fund will amount to $1.5 billion over a three-year period (2003-2004 to 2005-2006).

-

A Health Reform Fund is established with a budget of $16 billion over a five-year period (2003-2004 to 2007-2008), targeted to primary health care reform, home care and catastrophic prescription drug coverage. These cash transfers will be distributed to the provinces on a per capita basis. The Fund may be integrated into the CHT starting in 2008-2009, subject to a review by the First Ministers by the end of 2007-2008.

-

A CHST Supplement Fund of $2.5 billion is established to relieve existing pressures on the health care system, available to the provinces from 2003-2004 through 2005-2006 and accounted for by the federal government in 2002-2003. This CHST cash supplement will be transferred to the provinces on a per capita basis.

-

Effective in fiscal year 2004-2005, the CHST will be apportioned between the CHT and the CST. The proportion of cash and tax transfers allocated to the CHT will reflect the percentage of provincial health care spending within overall provincial spending in the health care and social sectors supported by the CHST. The remaining cash and tax transfers will be allocated to the CST.

-

The current definition of social programs in the CHST legislation (and the forthcoming CST) is extended to include early learning and child care initiatives.

Auditor General of Canada. “Federal Support of Health Care Delivery.” Report, Chapter 29. November 1999.

Banting, Keith and Robin Boadway (Queen’s University). Presentation to the Standing Committee on Finance, House of Commons. Ottawa, 9 May 1965.

British Columbia Medical Association. Turning the Tide – Saving Medicare for Canadians (Part I of II). Discussion Paper. July 2000.

Canadian Medical Association. On the Road to Recovery – An Action Plan for the Federal Government to Revitalize Canada’s Health Care System. September 2000.

Council of Canadians. Submission to the Standing Committee on Finance. Ottawa, 26 April 1995.

Department of Finance, Federal-Provincial Relations Division. Established Programs Financing – Final Calculation 1995-1996. Ottawa, 12 October 1998.

Government of Canada.

-

Federal Support to Post-Secondary Education: A Supplementary Paper. Ottawa, 1994.

-

“Health Ministers Reaffirm Federal/Provincial/Territorial Cooperation.” Press Release. Ottawa, 4 July 1995.

Government of Quebec, Department of Finance. Discours sur le budget et renseignements supplémentaires [Budget Speech and Additional Information]. Québec, 9 May 1995.

Health Action Lobby (HEAL). Submission to the Standing Committee on Finance on Bill C-76, The Budget Implementation Act. Ottawa, May 1995.

Madore, Odette.

-

Established Programs Financing for Health Care. Background Paper BP‑264E. Parliamentary Research Branch, Library of Parliament, Ottawa, August 1991.

-

The Canada Health Act: Overview and Options. Current Issue Review 94-4E. Parliamentary Research Branch, Library of Parliament, Ottawa, January 1995.

Meeting of Provincial Premiers and Territorial Leaders. Letter to the Prime Minister of Canada. 3 February 2000.

Mendelson, Michael. Looking for Mr. Good-Transfer: A Guide to the CHST Negotiations. The Caledon Institute of Social Policy, Ottawa, October 1995.

National Council of Welfare. The 1995 Budget and Block Funding. Ottawa, Spring 1995.

Neumann, Ronald H. “Negotiating Inter-Governmental Transfers in 1993: What Is on the Table?” Policy Options, Vol. 14, December 1993, pp. 31-35.

Provincial and Territorial Ministers of Health. Understanding Canada’s Health Care Costs – Final Report. August 2000.

Schroeder, Walter J., Brian A. Miron and Jeff Moore. Federal Transfer Payments: A Government Study by DBRS. March 1995.

* The original version of this Current Issue Review was published in September 1995; the paper has been updated regularly since that time.