Death of an RRSP annuitant : Rv4-6/2010E-PDF

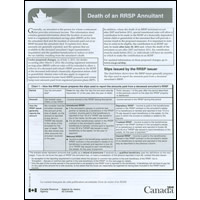

Contains general information about the taxation of amounts held in a registered retirement savings plan (RRSP) at the time the annuitant died and the taxation of amounts paid out of an RRSP because the annuitant died. It explains how these amounts are generally reported, and the options that are available to the deceased annuitant’s legal representative (liquidator) and the qualified beneficiaries to reduce or defer the tax liability resulting from the annuitant’s death.

Permanent link to this Catalogue record:

publications.gc.ca/pub?id=9.694569&sl=0

| Department/Agency | Canada Revenue Agency. |

|---|---|

| Title | Death of an RRSP annuitant |

| Publication type | Monograph |

| Language | [English] |

| Other language editions | [French] |

| Format | Electronic |

| Electronic document | |

| Other formats | Paper-[English] |

| Publishing information | Ottawa - Ontario : Canada Revenue Agency [2010]. |

| Description | 6p. |

| Catalogue number |

|

| Departmental catalogue number | RC4177(E) Rev. 10 |

| Subject terms | Survivor benefits |

Request alternate formats

To request an alternate format of a publication, complete the Government of Canada Publications email form. Use the form’s “question or comment” field to specify the requested publication.- Date modified: